ITII Results Part One: Overview of Different Markets and reactions to COVID

Posted By Gráinne Ni Ghiollagáin, SoolNua

Now in its third year, the annual ITII (Incentive Travel Industry Index) is fast becoming an indispensable report on the state of incentive travel, providing stakeholders with empirical data on its current and future evolution. This year’s findings are timely and meaningful as the industry prepares to recover anew in a post-COVID future. In the coming months we will look at various learnings from this report and share with you here on Motivate.

Introduction

COVID 19 has impacted the incentive industry drastically – with the cancelling of incentive programmes, rescheduling of events and even closures of some DMCs and incentive houses. However, with the prospect of a vaccine looming, it is important to analyse and evaluate when and how buyers predict incentive travel will return. The ITII 2020 survey and its results have allowed phenomenal access into the thoughts and minds of incentive agents and its end-users. This data can help us understand how to market our destinations, what markets to target and how the industry will be shaped in the future.

As usual, the ITII survey and its results have given some great insights into the trends in the incentive industry – programme inclusions, popular destinations, pace of RFPs, etc – however there is none more interesting than the buyers approach to COVID and in what way this has impacted how and when they will book their future incentive travel programmes.

This is a 6 part series in which we will give key insights into how buyers in different markets (European and North American) have responded to the pandemic. We will highlight how their overall programmes have changed, as well as what is most important to them when placing a piece of business for the future. By comparing and contrasting the two different regional approaches, suppliers will gain insights into where and how they should target these varying markets moving forward.

Demographics

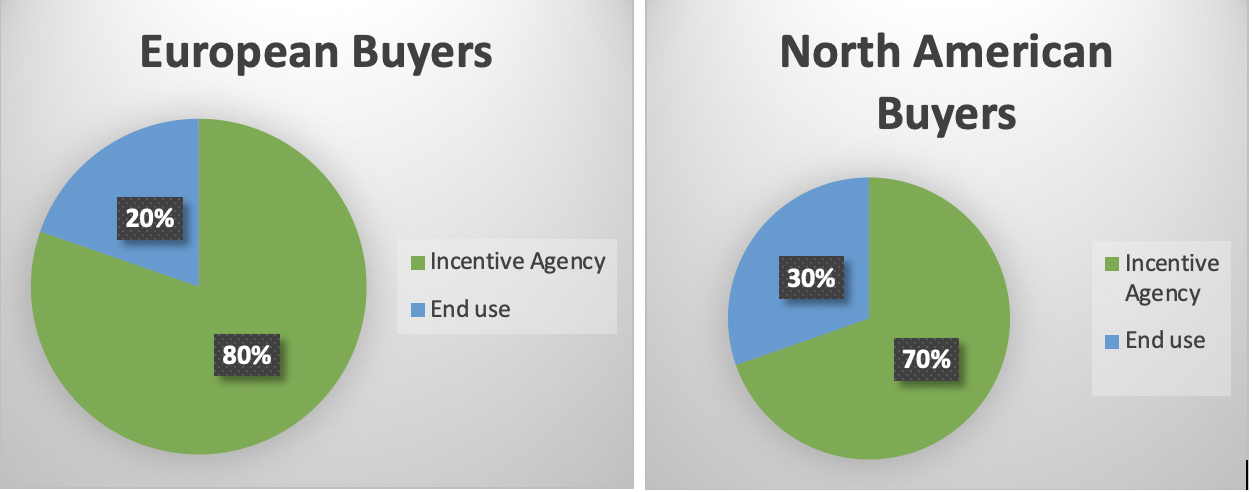

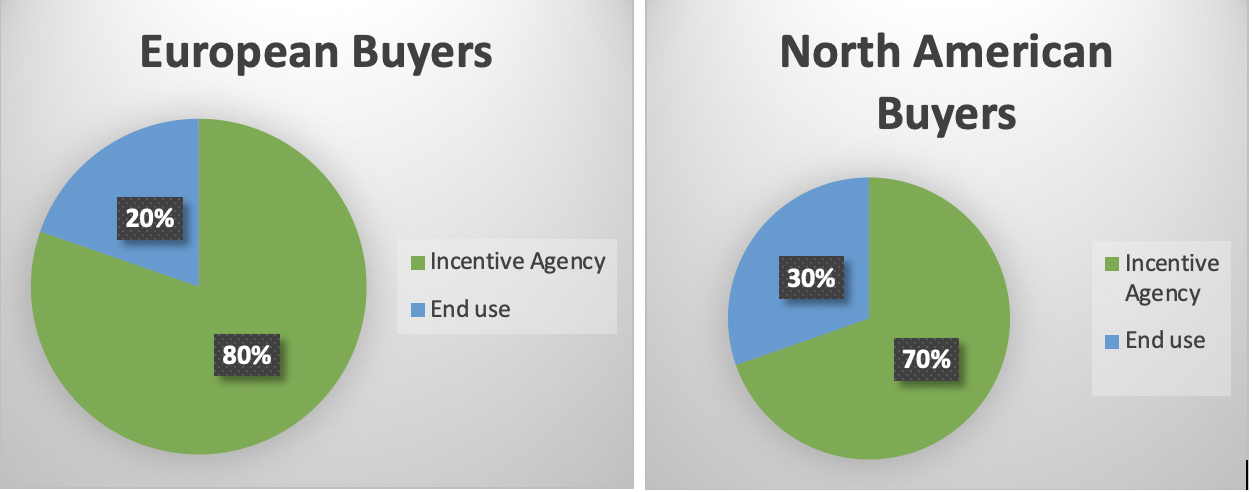

In total we had 249 buyers from European countries and 537 buyers from North American countries. Buyers were categorised as end-users (i.e. a corporate company) or as an incentive travel agency. A higher proportion of end-users (30%) came from North America when compared to European end-users (20%). However, this does not come as a surprise as North America is one of the more prominent incentive markets in the world, with many companies already having strong vested interest and investment in incentive travel programmes.

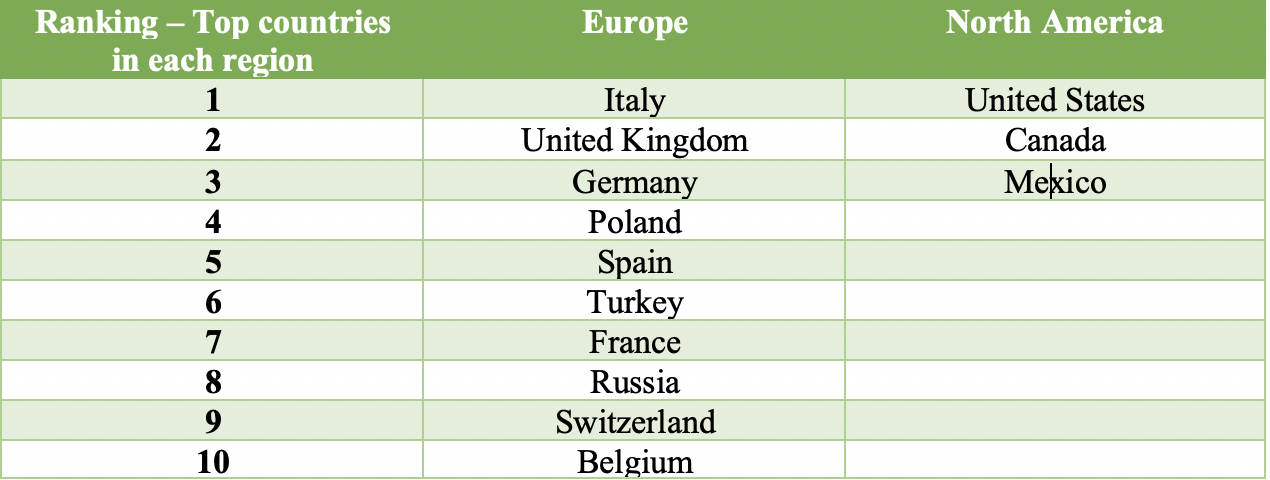

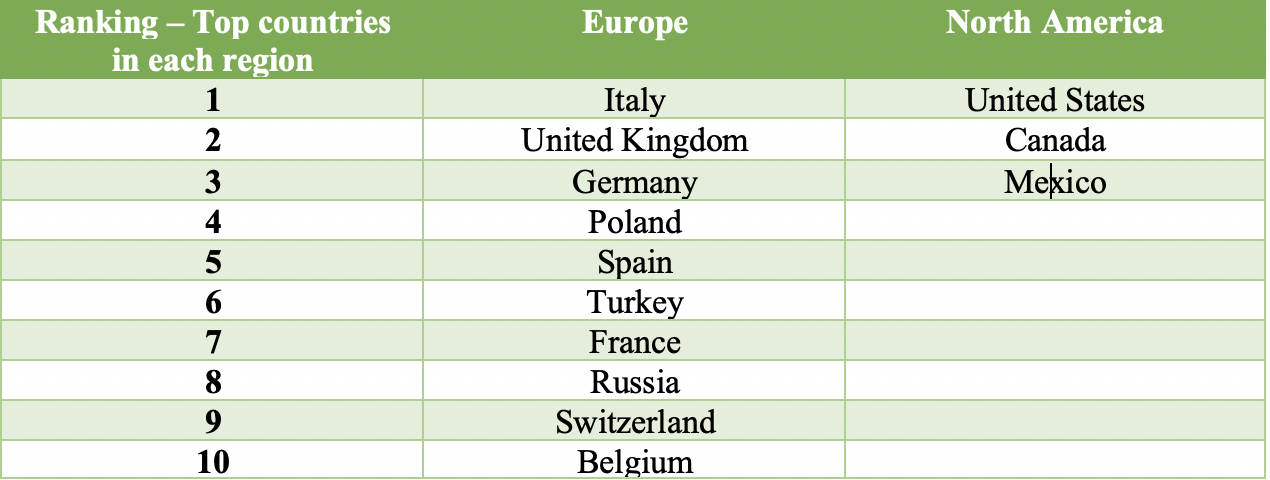

When we looked at European buyers, the top 5 countries where buyers were located included the following – Italy, The United Kingdom, Germany, Poland and Spain. While Italy, the UK, Germany and Spain are historically renowned as strong European incentive markets, the inclusion of Poland in the top 5 is a new addition. This shows the growth of the European incentive market over the years, in particular in emerging Europe, where more and more European companies turn to the merits of incentives to motivate and stimulate their staff.

As predicted, and following the pattern of previous ITII surveys, the United States came out strongly on top, not only in North America, but also in the world as the largest number of buyers – followed by Canada and then Mexico.

Industries

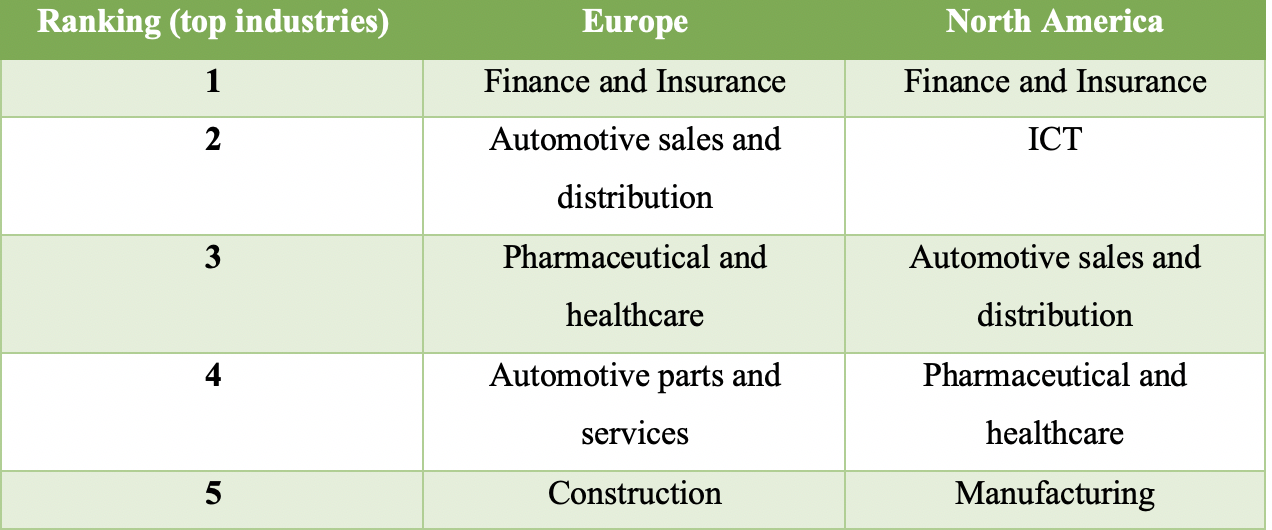

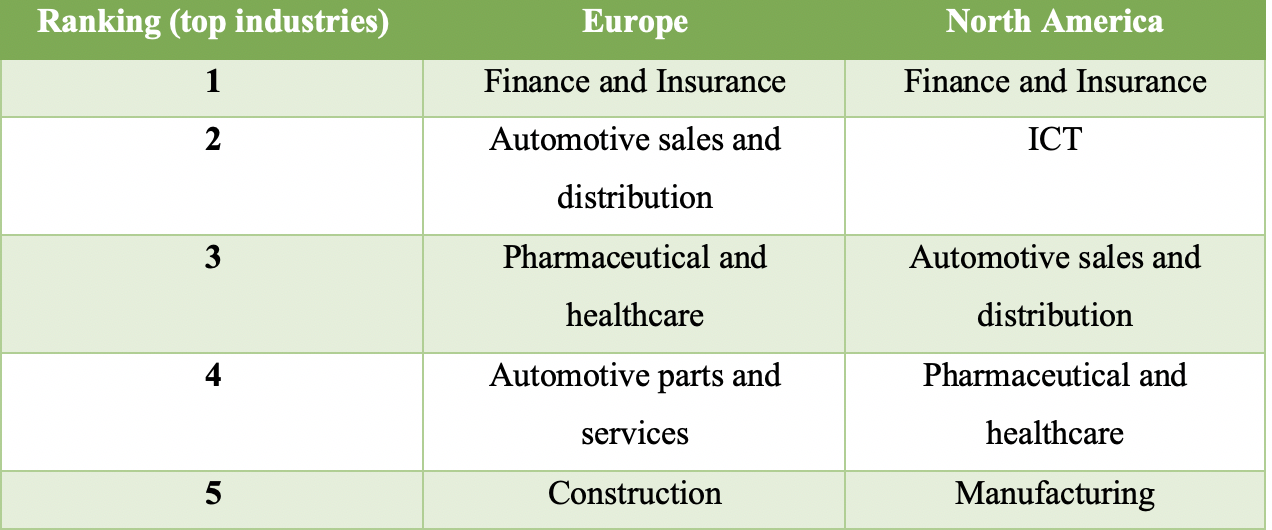

We also looked at what industries were most commonly represented in the incentive market – i.e. what industry the end-user company represented (or indeed was represented by the incentive travel agency). There were slight differences depending on the market.

As predicted, Finance and Insurance came out on top as the most important industry with over 30% of North American companies being from this industry and 23% of European buyers. However, while the ICT sector is the 2nd most popular industry in North America, it doesn’t even feature in the top 5 for Europe. This is likely due the fact that North America, in particular the US, is known worldwide as a leading country in relation to ICT and most of ICT companies are head quartered in the US.

Reaction to COVID

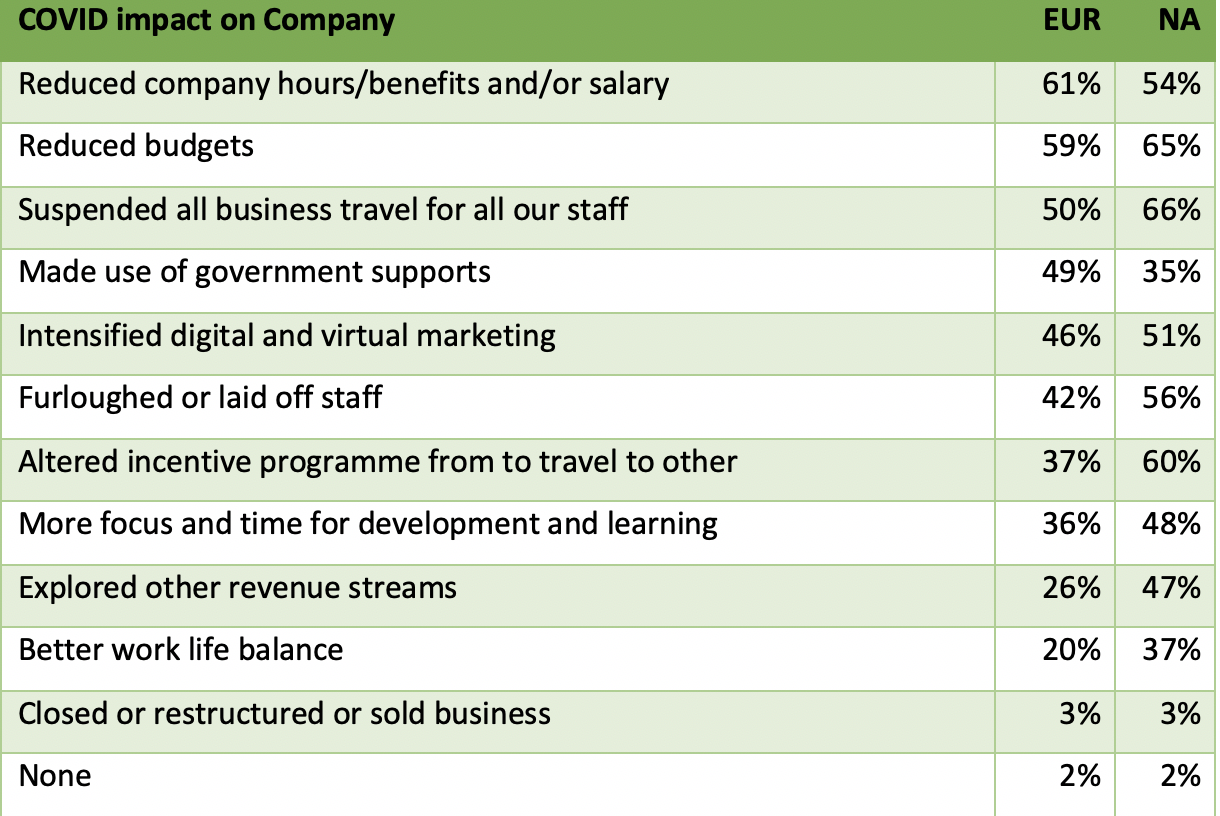

We examined how each market reacted to COVID and what level of impact the pandemic has had on the company’s overall running. We also looked at what markets played a more proactive role versus what markets played a more reactive role to the pandemic.

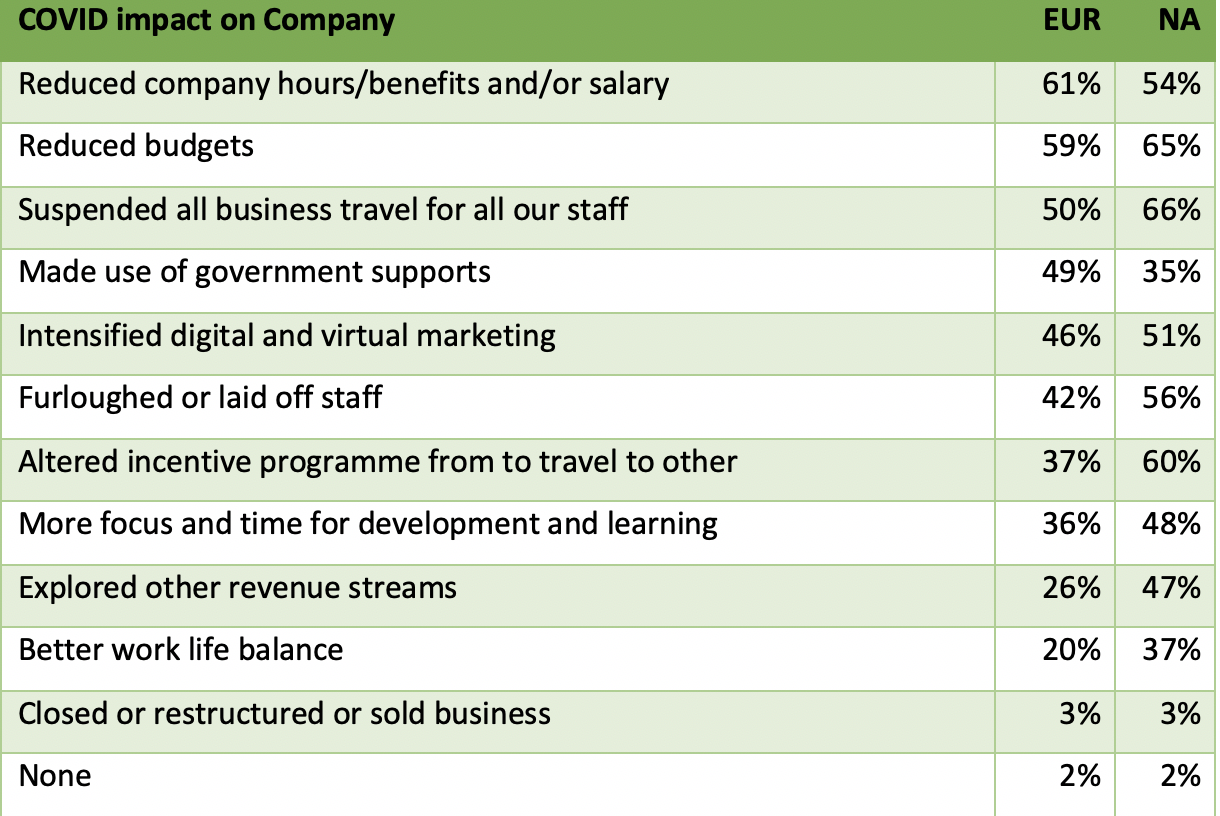

The good news overall was that very few companies in either market closed, restructured or sold their business (3% respectively), however, a large number did lay off or furlough staff (42% EUR vs 56% NA). While the North American market may have let more staff go than its European counterparts, this may be due to the fact that 49% of European buyers utilised government support to be able to keep staff on board as opposed to only 35% of North American buyers. However, this could be down to the fact that the supports offered by governments in Europe were more favourable than the supports offered in North America. Both markets reduced overall budgets, reduced company hours and suspended business travel for all staff.

Overall, North American buyers showed a more proactive approach to the pandemic –utilising the time to explore new revenue streams (47% vs 26%), focus on learning and development (48% v 36%) and alter their incentive programme from travel to another type, to ensure leading employees were still awarded (60% v 37%).

COVID-19 has impacted my business/employer in the following ways so far in 2020

Business Outlook

Finally, we looked at the different markets and their business outlook for the future. While COVID has brought with it a level of uncertainty, fear and anxiety – it too has brought some positivity. It has allowed companies time to examine and inspect their overall offerings and look to the future.

The proactive approach we encountered from the North American buyers in relation to COVID’s impact on its companies follows through to their business overlook for the future. Whilst the European buyers appreciate the need for change, North American buyers clearly show a stronger reliance.

While both markets understand the importance of training and development and the importance of acquiring new skills, such as the ability to deliver virtual events – North American buyers are definitely more cognisant of this need (71% NA v 55% EUR). Similarly, although European buyers understand the need to examine their risk management strategy and place greater importance on contracting, North American buyers are ahead in this also, with 19% more respondents emphasising the importance of these areas.

This proactive business outlook approach is seen throughout all elements in this segment, with North American buyers being more resilient and agile, investing more in technology, building stronger relationships, leaner options, being more involved in community and societal engagement and having better connections with professional associations than their European counterparts. Interestingly enough, the only area in which European buyers were more proactive than North American buyers is when it comes to focusing on sustainable travel.

Of the changes made in light of COVID-19, which of the following effects will be the most important to you and your business/employer’s future success?

Motivate